How Employers in Poor Countries Are Using Nudges to Help Employees Save Money

By Joshua Blumenstock, Michael Callen, and Tarek Ghani

One of the most common ways to get people to save is through their employer. In particular, behavioral economics—that marriage of economics and psychology that has put terms like “nudge” into the popular lexicon—has provided a powerful tool for increasing savings, in the form of the default enrollment. The idea is simple: people save more in retirement accounts when they are automatically enrolled by their employer than when they have to sign up themselves. Most U.S. employers have adopted default savings programs, but the idea is only just entering poor countries, where saving is less common. According to World Bank figures, half of adults in high-income OECD countries save in a formal account; in developing economies, it’s only one in five. But we now have some evidence about how to scale nudges to help change this.

Along with other aspects of the formal financial ecosystem—ubiquitous banks, ATMs, and credit cards—default savings programs have historically been the province of rich countries. But recently, the world has seen a dramatic drop in the numbers of unbanked adults due to the rapid spread of mobile money. The number of people with phones is far higher than the number of people who have easy access to traditional bank branches, especially among the rural poor. Prior to our study, however, no one had tested whether mobile banking could facilitate default savings programs. In a recent paper, we found that nudging employees to save worked in Afghanistan, one of the world’s least financially developed countries.

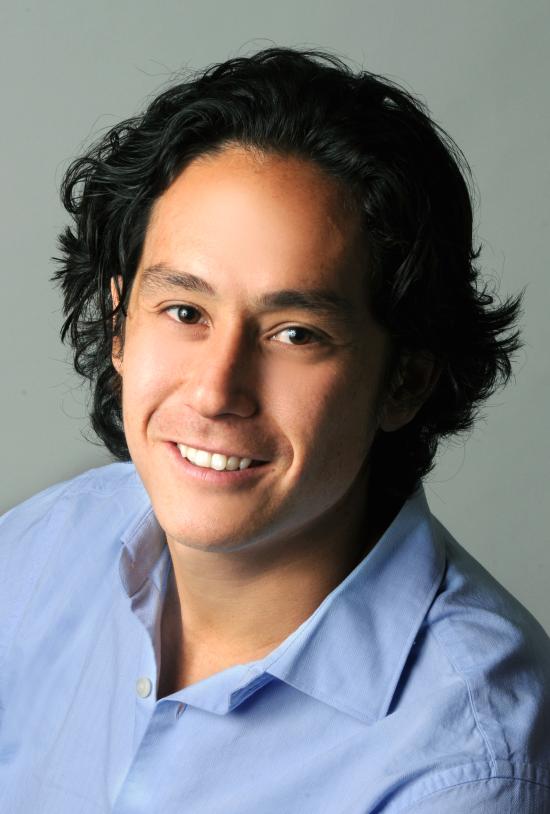

Joshua Blumenstock is an assistant professor at the UC Berkeley School of Information, where he directs the Data-Intensive Development Lab.