Pyxis: Generate investment alpha with clustering

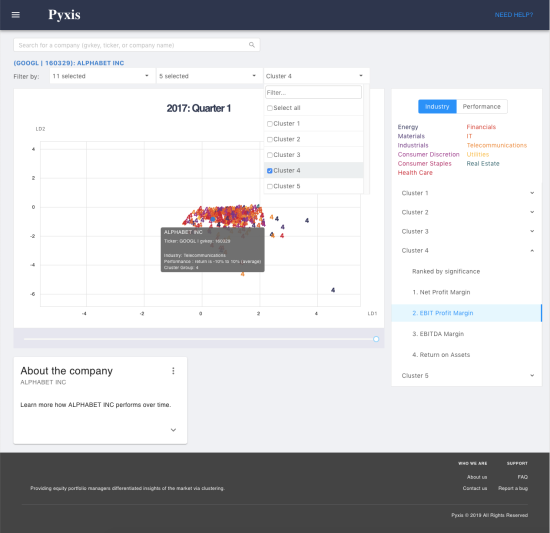

We began our journey by wondering if we could classify stocks differently from the traditional industrial classification codes or valuation metrics. Our solution uses clustering to identify similar businesses based on operating metrics. Speaking with portfolio managers in the field we understood that interpretability of the clusters was paramount. We built this logic into the product so users can understand what factors drive stocks to be in the same cluster. We took our project a step further by trying to prove these clusters contained information more than just being nice to look at. To do this we utilized them in the prediction of relative forward returns — a notoriously difficult task. We hope you enjoy using Pyxis as much as we did building it. Please do not hesitate to reach out to us if you want to provide feedback or explore ways to further improve Pyxis.