13F Navigator

About

13F Compass is the final project for Matt Kirk and Vernon Robinson for W209 Fall '23 Sec-1. The intended audience is both retail and institutional investors in US public markets. The visualization's goals are to assist investors with identifying opportunities for excess returns from investing by helping them analyze the historical performance of disclosed portfolios of US-listed long positions for institutional asset managers in the US public markets. Data is sourced from the SEC, CapitalIQ and Yahoo Finance.

What is a 13F?

The SEC mandates significant portfolio holding disclosures be made by sophisticated institutional investors that participate in the US public markets. While the body of data is substantial, disclosures are made in a way that is difficult to distill and glean insights from.

Why do we need the 13F Compass?

This tool aims to be the bridge from the body of data available to public market investors from legally required disclosure filings to actual portfolio insights for those that seek them from observing what the world's best investors are doing.

Specifically, this tool will:

-

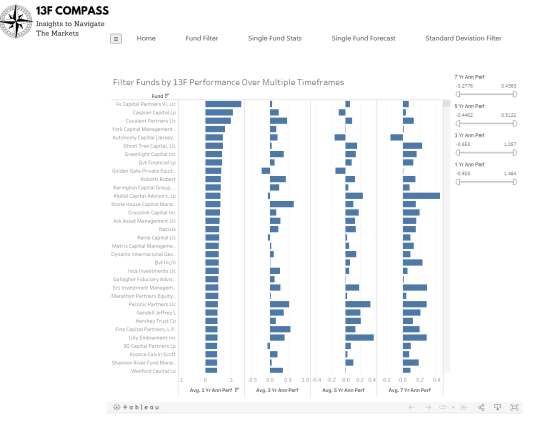

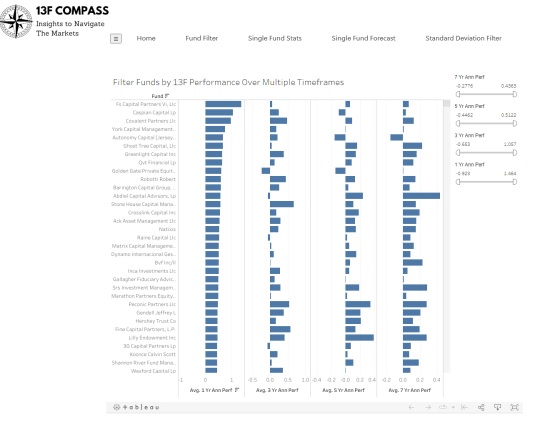

Provide a comprehensive overview of asset manager disclosed US long positions performance (assuming all trades happen end of each quarter, no intraquarter trading) to be utilized by both institutional and retail investors. We will call this 13F Performance.

-

Offer users an analysis of the 13F Performance of US institutional asset managers across various time frames, utilizing data from SEC 13F Filings.

-

Allow users to conduct a comparison of multiple managers, assessing their consistency, tracking portfolio decisions over time, and identifying those managers who consistently outperform the market with their 13F Performance.