Predicting Property Rent Loss due to Climate Physical Risk

Problem and Motivation

Even in times such as the current macroeconomic climate, where real estate investors and lenders are more highly focused on underwriting assumptions and financial sensitivity analyses, we believe that these groups are continuing to overlook and under analyze the potential impacts of climate change on their investments.

With climate events becoming more prevalent and natural disasters likely to have an effect on investments in physical structures (i.e., real estate), we believe it is imperative for real estate investors to take into account climate physical risk information in their underwriting models.

We believe that gating factors to this type of analysis is that:

- Climate physical risk data is difficult to access, stale, and in too large of a scope for an average analyst to decipher.

- “Industry standard” financial analysis is typically conducted in Microsoft Excel which is not conducive to handling large-scale data and data science modeling.

- Without readily available data and easily interpretable analysis, many investors may continue to neglect this risk.

Data Source & Data Science Approach

We utilized data from several different sources:

- Proprietary property level financial data, sourced from a leading Southeastern Real Estate investor.

- Hurricane tracking data from NOAA.

- Climate Physical Risk data from FEMA.

- Macroeconomic data from FRED.

Our modeling approach began with an evaluation of “industry standard” modeling, using a broad rent growth assumption for properties, and evaluating recall and accuracy of these models across our data set.

Our second step was to build a “baseline” model using data science techniques but only economic and financial data (similar to what industry participants are using from a data perspective but with enhanced modeling).

Lastly, we included climate physical risk and hurricane data to augment our baseline model with a goal of improving recall (given that we believe underwriters would rather be more conservative than less conservative).

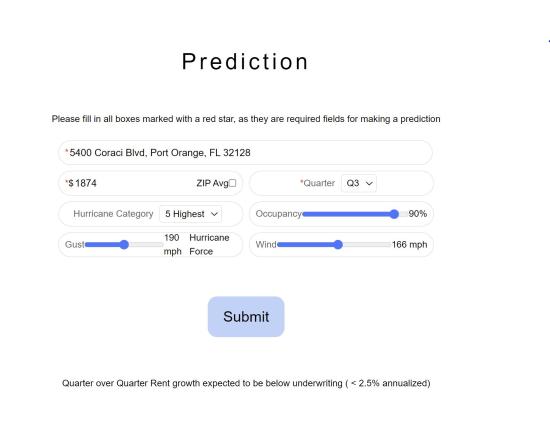

Our models were aimed to predict next period rent growth given the event of a hurricane as a way for industry participants to sensitize their property financial models.

To handle imbalance in outcome variables across our data set, we utilized SMOTE and stratified random sampling to improve our modeling and underlying data sets.

Modeling was focused on non-parametric models given the time series aspects of the underlying data.

Evaluation

We found that using a data science approach and including climate physical risk data provides higher recall and accuracy than the “industry standard” and baseline approaches.

Several modeling approaches, including logistic regression, SVM, XG Boost, and Random Forest were used and we found that Random Forest provided the best recall and accuracy.

Final model that was productionalized has accuracy of 86% (compared to 78% in the baseline) and significantly better recall as compared to the baseline modeling.

Key Learnings & Impact

Climate physical risk is an impactful variable in terms of rent growth prediction for real estate investors and should be analyzed to fully understand potential risks to an investment.

While real estate investors may have loss of income covered by insurance policies, short-term impacts of significant deviations from underwriting in rent growth can have meaningful implications on investor returns, yield, and ability to service debt.

Acknowledgements

We would like to acknowledge our advisors, Alberto Todeschini and Puya Vahabi.

Additionally, we would like to acknowledge the team at S2 Capital for providing property level financial data for our analysis.

Finally, we would like to thank our classmates for their thoughtful feedback, questions, and suggestions throughout the semester.