Predictly: Predicting Startup Success

Problem & Motivation

Venture capitalists receive a vast number of investment opportunities annually, but evaluating each startup is time-consuming and stressful. With only 10% of startups succeeding, the challenge is to identify the most promising opportunities and maximize returns. Our solution provides an efficient way to evaluate startups, enabling venture capitalists to save time and make informed investment decisions with greater confidence.

Data Source & Data Science Approach

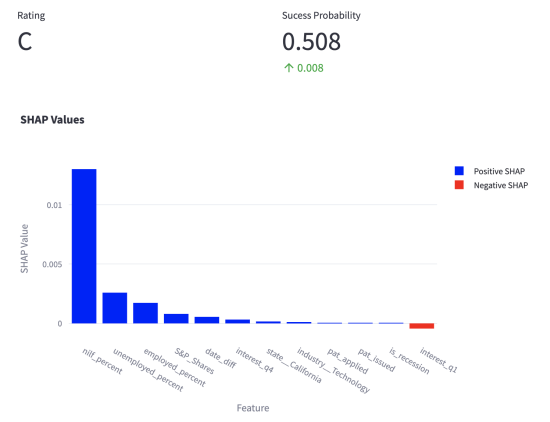

Our team has developed a comprehensive machine learning model that utilizes diverse data sources, including Preqin Venture, Crunchbase Venture, US Patent (USTPO), Google Trends, Current Population Survey Data for Social Economic Health Research (IPMUS-CPS), and macroeconomic data, to accurately assess a startup's potential for success. We employed an XGBoost machine-learning model with SMOTE sampling to ensure the most precise predictions. Our user-friendly UI/dashboard also simplifies complex decision-making by providing clear explanations behind each prediction.

Evaluation

We used the overall F1-score metrics to assess our model's accuracy. We prioritized precision over recall because of the venture capital industry's emphasis on identifying high-quality investment opportunities with strong potential for success. It is better to miss out on a potential opportunity than to suffer losses due to a poor investment decision.

Key Learnings & Impact

Our project has been a journey of growth and learning as we tackled the challenges inherent in the venture capital industry. Throughout this process, we gained important insights into the crucial role that diverse data sources and precision play in predicting startup success. Despite encountering obstacles, such as the significant class imbalance and scarcity of publicly available data, we remained committed to our goal of developing a tool that can help streamline the decision-making process for venture capitalists in identifying and supporting promising startups. We are grateful for the reflective key learnings gained through this project and are confident that they will inform and guide our future work in this space.

Acknowledgments

We'd like to acknowledge our Capstone Advisor Joyce Shen for providing us with her wealth of knowledge and insight into the field of venture capitals and investing.