SideCar Automated Programming Interface (API) Security

Problem Statement

In the fast-paced fintech industry, where rapid API development is essential for competitive edge, the shift towards microservices architecture heightens the security risks associated with APIs. This scenario is exacerbated by the fact that 60% of organizations report data breaches due to API vulnerabilities. Fintechs are under pressure to quickly develop and deploy numerous APIs, adding to their already extensive portfolios of APIs in production. Traditional security tools like Web Application Firewalls (WAF) and API gateways, while necessary, are often insufficient in detecting and mitigating sophisticated attacks, such as low and slow intrusions. This gap in security leaves sensitive financial data exposed and increases the burden on API Security Managers to protect against these vulnerabilities amidst complex regulatory demands. SideCar, designed to augment traditional API security measures, addresses this critical need for enhanced, nuanced security solutions in an environment where comprehensive API management and oversight are often lacking.

In the fast-paced fintech industry, where rapid API development is essential for competitive edge, the shift towards microservices architecture heightens the security risks associated with APIs. This scenario is exacerbated by the fact that 60% of organizations report data breaches due to API vulnerabilities. Fintechs are under pressure to quickly develop and deploy numerous APIs, adding to their already extensive portfolios of APIs in production. Traditional security tools like Web Application Firewalls (WAF) and API gateways, while necessary, are often insufficient in detecting and mitigating sophisticated attacks, such as low and slow intrusions. This gap in security leaves sensitive financial data exposed and increases the burden on API Security Managers to protect against these vulnerabilities amidst complex regulatory demands. SideCar, designed to augment traditional API security measures, addresses this critical need for enhanced, nuanced security solutions in an environment where comprehensive API management and oversight are often lacking.

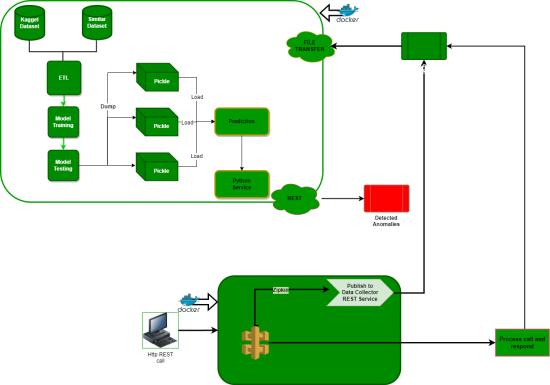

SideCar's API Traffic Anomaly Detector (API-TAD) is an innovative solution tailored to the fintech sector's specific needs, particularly in the context of microservices architecture. This solution offers a multi-layered approach for comprehensive protection:

First Layer

Existing Security Infrastructure: customers can continue to rely on their existing Web Application Firewall or API gateway security solutions. These static rule security engines filter out known attack types and can be configured to implement accepted security frameworks like CIS or NIST.

Second Layer

Advanced Machine Learning: a sophisticated RandomForest model is specifically adept at detecting anomalies, making it highly effective against application-specific threats, such as low and slow attacks, like data leaks. This is a significant advancement over traditional methods, which often fail to detect these types of attacks due to their subtlety and complexity.

Beyond Detection – Proactive Defense

Unlike conventional solutions that rely on static rules, Sidecar's API-TAD evolves into a proactive defense system. It is designed to adapt to various user behaviors and effectively detect elusive or zero-day attacks. This adaptability is crucial, considering the expectation of a 61% increase in API risk among organizations.

Tailor-Made for Fintech – Strategic Edge

Sidecar's API-TAD is not merely a security tool; it's a strategic asset, especially for the fintech industry. Our solution combines machine learning with rule-based methodologies, enhancing its efficiency in recognizing and adapting to sophisticated attack patterns. This approach is vital in an industry where a significant portion of organizations lack comprehensive policies for API management and oversight.

Conclusion

As the fintech industry continues to evolve with microservices architecture, the necessity for a nuanced, multi-layered security strategy becomes increasingly critical. Sidecar's API-TAD offers more than just defense; it positions itself as a strategic partner in the digital evolution of fintech, ensuring the protection and security of data and assets against the complex backdrop of digital threats.